Southeast Asia is entering a major turning point with AI adoption in ASEAN economy. The region’s digital economy is projected to pass $300 billion in GMV by 2025, with revenues expected to reach $135 billion. Growth remains steady at 15% year-on-year, supported by rapid online adoption and over 200 million new internet users in the past decade.

This growth sets the stage for a deeper transformation: the rise of embedded finance and the fast expansion of artificial intelligence. Together, they are reshaping how young people work, spend, and access financial services.

AI Becomes a Core Driver of Regional Growth

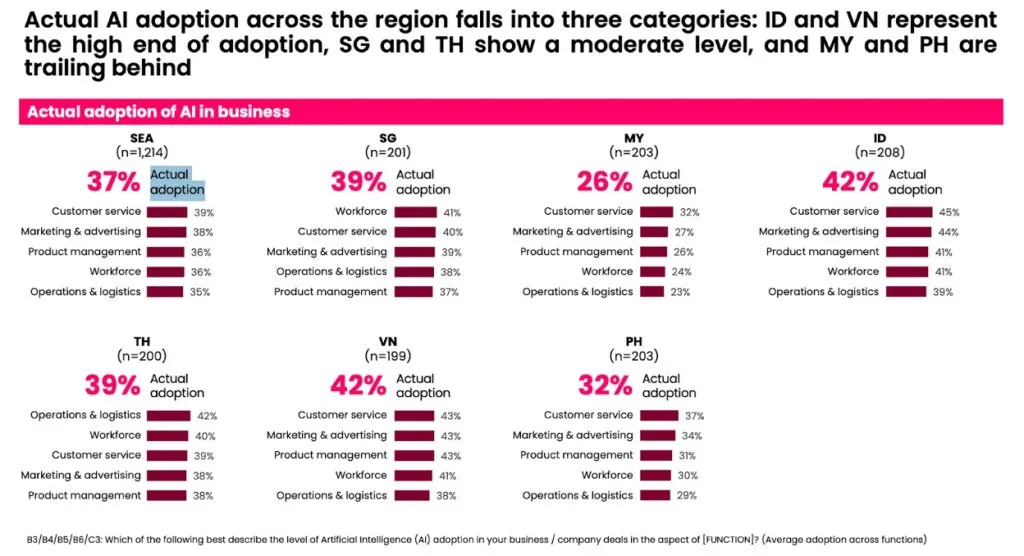

AI is becoming one of the region’s most powerful forces. The AI market in ASEAN is projected to hit US$8.92 billion in 2025, showing sharp acceleration. In 2023 alone, AI projects rose by 80%, and budgets are expected to climb by another 67% in 2024-2025.

These numbers reveal strong confidence despite challenges in execution. By 2030, AI is estimated to contribute 10% to 18% of ASEAN’s GDP, which could be close to $1 trillion. Industries gaining the most include manufacturing, retail, healthcare, and agriculture.

The scale of this shift explains why AI adoption in ASEAN economy is now considered a foundation for long-term regional competitiveness.

AI Adoption in ASEAN Economy is Due to Gen Z

While AI grows in the background, everyday financial habits in ASEAN are also changing fast. More than 60% of all transactions in Southeast Asia now come from digital payments, showing how deeply embedded finance has entered daily life.

For Gen Z, these tools are not optional — they are the default.

Embedded finance includes:

- Buy Now Pay Later (BNPL)

- In-app insurance

- Digital wallets integrated directly into platforms

These services make payments easier, credit more accessible, and financial decisions more personalized.

BNPL, in particular, has reshaped spending behavior. Young users no longer rely on traditional banks for short-term credit. Instead, they use digital platforms that offer instant approvals, simple terms, and built-in payment reminders. This shift has weakened the role of conventional banks among younger consumers.

Read Also: Unveiling Southeast Asia Trade AI Disruption Drivers & Trends

Read Also: Southeast Asia Crypto Payments Boom Reshapes Finance

Digital-First Banks Reinvent AI Adoption in ASEAN Economy

New digital-only banks and embedded finance ecosystems show how quickly the region is changing. Examples include:

- Cake by VPBank

- GoTyme Bank

- Bank INA

These platforms are not traditional banks in the old sense. They use non-financial platforms — such as e-commerce apps, ride-hailing services, and lifestyle ecosystems — to deliver financial products where users already spend their time.

This strategy increases financial inclusion and reaches users who may have avoided or mistrusted traditional banking.

AI adoption in ASEAN economy: The Combined Power of AI and Embedded Finance

As AI becomes more common and embedded finance continues to expand, the two trends will reinforce each other. AI will support fraud detection, credit scoring, customer support, and risk management. Embedded finance will provide the channels through which millions of Gen Z users access these AI-powered services.

Both trends move ASEAN toward a more digital, accessible, and user-driven economic model.

Read Also: DBS and Banque Saudi Fransi to Boost Southeast Asia Middle East Trade Payments

The Road Ahead for a Connected Digital ASEAN

The rise of digital payments, embedded finance, and AI signals a new era for Southeast Asia. With fast-growing internet adoption and strong investment momentum, the region is ready for deeper integration between technology and daily financial life.

The future of AI adoption in ASEAN economy will depend on how well businesses and governments support this shift while protecting users and improving access. For organizations searching for guidance on digital strategy, AI integration, or financial innovation, Market Research Southeast Asia can help. Their global expertise supports companies navigating the complex transition toward AI-powered and embedded financial ecosystems.